Renting vs. Buying: Which is Better for Your Finances?

When it comes to noteworthy money related choices, few are as impactful as choosing between leasing vs. buying a domestic. Each choice has its interesting points of interest and drawbacks, and the best choice frequently depends on person circumstances, monetary objectives, and showcase conditions. This article digs into the budgetary contemplations of leasing vs. buying to offer assistance you make an educated decision.

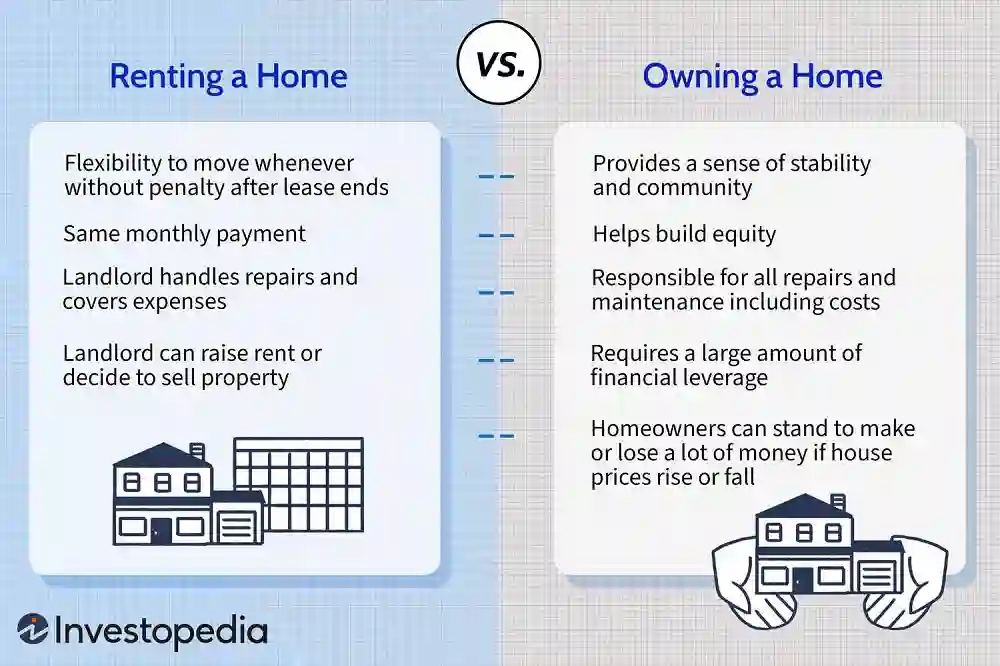

The Monetary Stars and Cons of Renting

Advantages of Renting

Lower Forthright Costs Leasing ordinarily requires less cash forthright. Whereas you may require to pay a security store and the to begin with month’s lease, these costs are negligible compared to a down installment on a house. Flexibility Leasing offers the adaptability to move without the long-term commitment of owning property. This is particularly useful for those who may move for work or favor attempting distinctive neighborhoods. No Support Costs As a leaseholder, you’re not capable for major repairs or upkeep. The proprietor handles these costs, permitting you to spare cash and dodge unforeseen costs. Predictable Month to month Costs Lease installments are regularly settled for the term of a rent, making it simpler to budget your month to month expenses.Disadvantages of Renting

No Value Building One of the primary downsides of leasing is that your installments don’t contribute to building value. Over time, this can feel like you’re losing money. Rent Increments Proprietors can raise lease costs when leases are reestablished, possibly making leasing less reasonable over time. Limited Personalization Leaseholders frequently confront confinements on customizing their living space, which may not feel as individual or fulfilling as owning a home.The Budgetary Masters and Cons of Buying

Advantages of Buying

Equity Building When you make contract installments, a parcel goes toward building value in your domestic. Over time, this value can gotten to be a profitable monetary asset. Potential for Appreciation Genuine bequest values regularly increment over time, meaning your domestic may appreciate in esteem and give a return on your investment. Tax Benefits Property holders may qualify for charge derivations on contract intrigued and property charges, possibly bringing down their by and large charge burden. Long-term Solidness Owning a domestic gives soundness, with no hazard of being inquired to take off or confronting startling lease increments. You moreover have the opportunity to redesign or adjust the property as you see fit.Disadvantages of Buying

High Forthright Costs Acquiring a domestic requires a critical money related commitment, counting a down installment, closing costs, and other expenses. These costs can be a boundary for numerous imminent buyers. Maintenance and Repairs As a property holder, you’re capable for all upkeep and repair costs, which can be unusual and expensive. Market Dangers Genuine bequest markets can change, and there’s no ensure your home’s esteem will appreciate. In a few cases, property holders may conclusion up owing more on their contract than the property is worth. Lack of Adaptability Offering a domestic can be a long and exorbitant prepare, making it harder to move or adjust to changing circumstances.Key Components to Consider

When choosing between leasing vs. buying, it’s basic to assess a few factors:1. Monetary Situation

Assess your investment funds, credit score, and month to month pay. If you need a adequate down installment or have a destitute credit score, leasing might be the superior alternative in the brief term.2. Length of Stay

If you arrange to remain in a area for a few a long time, leasing offers more adaptability. Buying gets to be a more alluring alternative if you proposed to settle down for at slightest 5-7 years.3. Nearby Advertise Conditions

Research the taken a toll of leasing vs. buying in your region. In a few markets, month to month contract installments might be comparable to or indeed lower than lease payments.4. Way of life Preferences

Consider your individual inclinations and long-term objectives. Do you esteem adaptability or solidness? Are you arranged for the obligations of homeownership?5. Future Budgetary Goals

Think almost how buying or leasing adjusts with your broader monetary objectives. For case, if you prioritize sparing for retirement or other speculations, leasing may free up reserves for those purposes.- Renting vs. Buying: A Money related Comparison

- To outline the money related suggestions of leasing vs. buying, let’s consider an example:

- Scenario A: Leasing Month to month Lease: $1,500 Yearly Lease Increments: 3% Add up to Month to month Costs (counting utilities): $1,800

Conclusion

Deciding between leasing vs. buying depends on different components, counting your budgetary circumstance, way of life inclinations, and long-term objectives. Leasing may be the superior choice for those looking for adaptability, lower forthright costs, and less obligations. On the other hand, buying a domestic can be a astute speculation for people prepared to commit to homeownership and take advantage of potential value building and assess benefits. Ultimately, the right choice is individual and ought to be based on cautious thought of your circumstances and needs. By weighing the masters and cons of leasing vs. buying, you can make the choice that best underpins your budgetary well-being.Read More latest Posts

- Who Is Alex Cosani? Biography And Rising Fame Explained Now

- Erin French Age, Biography, Career, and Net Worth Details

- Star Wars Puns That Are So Hilarious They’re Out of Galaxy

- Mayim Bialik Husband Identity And Relationship History Revealed Here

- TechVib’s Guide to the Best Amazon Echo Speakers in 2025