The Extreme Direct to Saving Money Easily

Saving Money is a pivotal viewpoint of individual back, and the great news is that it doesn’t have to be troublesome. With the right approach, Saving Money can ended up a propensity that you consolidate into your every day schedule, making a difference you construct a secure budgetary future. In this extreme direct, we will investigate down to earth steps on how to begin Saving Money effectively and reliably, and how you can make Saving Money a characteristic portion of your lifestyle.

Why Saving Money is Important

Before you start investigating how to spare cash, it’s fundamental to get it why Saving Money things. Saving Money not as it were gives you the money related security to handle unforeseen costs but moreover makes a difference you construct riches over time. Whether you’re pointing to spare for an crisis finance, a down installment on a house, or retirement, Saving Money is an critical establishment for accomplishing your monetary goals.Step 1: Make a Budget

One of the to begin with and most successful ways to begin Saving Money is by making a budget. A budget permits you to track your salary and costs, making a difference you recognize regions where you can cut back and spare cash. When you make a budget, you apportion cash for Saving Money, which guarantees that you prioritize your budgetary future.How to Make a Budget for Saving Money

Start by posting all of your pay sources and your month to month costs. At that point, subtract your costs from your pay to see how much cash is cleared out. This extra cash can be designated toward your reserve funds. By making a practical budget, you can guarantee that Saving Money gets to be a need and that you’re remaining on track with your budgetary goals.Step 2: Mechanize Your Savings

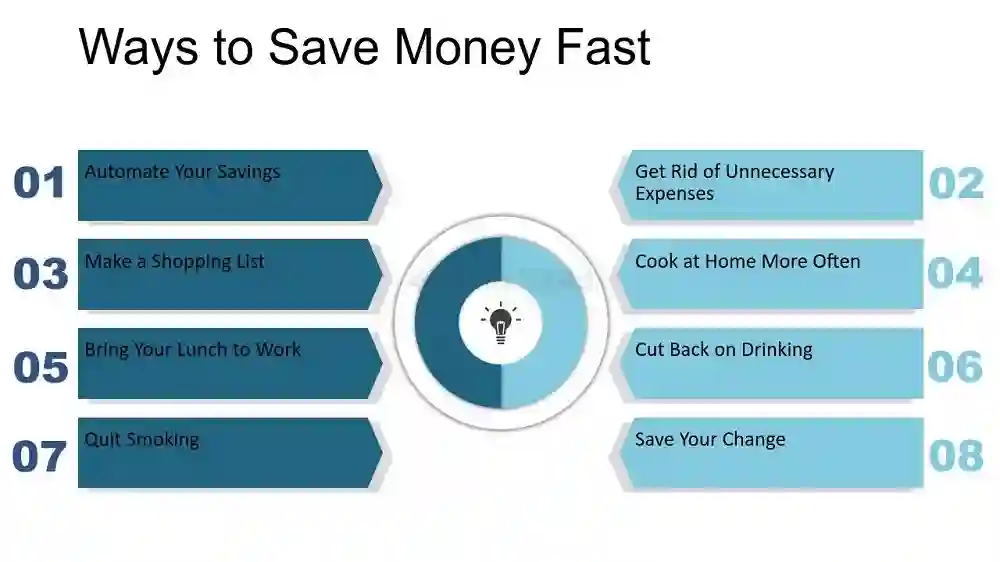

Saving Money gets to be much less demanding when you robotize the handle. Setting up programmed exchanges from your checking account to a investment funds account can offer assistance you spare cash reliably without considering almost it. Numerous banks and budgetary educate offer programmed investment funds choices, permitting you to plan exchanges on a week by week or month to month basis.Why Robotization Makes Saving Money Easier

Automating your reserve funds expels the allurement to spend the cash some time recently you can spare it. You’re more likely to adhere to your reserve funds objectives when you don’t have to physically make the exchange each time. This reliable Saving Money handle too makes a difference you construct riches without additional effort.Step 3: Cut Back on Non-Essential Expenses

An simple way to spare cash is by cutting back on superfluous costs. Regularly, we don’t realize how much we spend on non-essential things that we might do without. By cutting back on these costs, you can divert that cash into investment funds, permitting you to spare cash more efficiently.Areas Where You Can Spare Money

Take a closer see at your every day costs. Are there memberships you no longer require? Can you cook at domestic more frequently instep of eating out? By trimming these non-essential costs, you can altogether increment your reserve funds. Saving Money is frequently almost making little, every day choices that lead to greater monetary changes over time.Step 4: Set Reasonable Investment funds Goals

Setting particular and practical reserve funds objectives is key to Saving Money. If you don’t have a clear target, it can be difficult to remain spurred. Whether you need to spare cash for an crisis support, a excursion, or a major buy, having clear objectives can offer assistance you remain centered and committed.How to Set Objectives for Saving Money

Break your investment funds objectives down into littler, achievable steps. For illustration, if you need to spare cash for an crisis finance, begin by setting a objective to spare $500 in the following three months. Once you reach that objective, alter your investment funds arrange to proceed building your support. Clear and practical objectives make Saving Money feel less overpowering and more attainable.Step 5: Utilize Cash Back and Rewards Programs

Take advantage of cash-back and rewards programs to spare cash on ordinary buys. Numerous credit cards and apps offer cash back on foodstuffs, gas, and other common costs. By utilizing these programs deliberately, you can gain rewards whereas Saving Money on things you would have bought anyway.How to Maximize Rewards for Saving Money

When utilizing cash-back programs, make beyond any doubt to pay off your adjust in full each month to dodge intrigued charges. This guarantees that you are getting the full advantage of Saving Money without falling into obligation. Over time, the cash back you win can be put into investment funds or utilized to decrease your month to month expenses.Step 6: Decrease Utility Bills and Spare Money

Another extraordinary way to spare cash is by diminishing your utility bills. Little changes in how you utilize vitality and water can lead to critical investment funds over time. By being more careful of your vitality utilization, you can lower your month to month bills and free up more cash for savings.Simple Ways to Spare Cash on Utilities

Turn off lights when you take off a room, unplug gadgets when not in utilize, and consider exchanging to energy-efficient apparatuses. These basic activities can offer assistance diminish your utility costs, giving you more cash to put toward your investment funds goals.Step 7: Construct an Crisis Fund

One of the most imperative angles of Saving Money is having an crisis finance. An crisis support acts as a monetary pad for startling costs, such as therapeutic bills, car repairs, or work misfortune. Without an crisis support, you may be constrained to depend on credit cards or credits, which can lead to debt.How to Begin Saving Money for an Crisis Fund

Start by sparing a little sum each month until you reach your objective. Point for three to six months’ worth of living costs. Having this finance in put gives peace of intellect, knowing that you have cash set aside for crises, and it keeps you from plunging into your long-term savings.Step 8: Spare Cash on Groceries

Grocery bills can take up a expansive parcel of your month to month costs. Be that as it may, there are bounty of ways to spare cash on foodstuffs without relinquishing quality or sustenance. With cautious arranging and shopping propensities, you can decrease your basic supply investing and spare cash in the process.Tips for Saving Money on Groceries

Shop with a list to dodge drive buys, take advantage of deals and coupons, and consider buying in bulk. These techniques can offer assistance you cut down on your basic supply charge and increment your savings.Step 9: Contribute in Your Future to Spare Money

Investing is an vital step toward building riches and Saving Money for the long term. Whether you select to contribute in stocks, bonds, or common stores, your ventures can develop over time, giving you with monetary security and the capacity to reach your goals.How to Begin Contributing and Spare Money

You don’t require a huge sum of cash to begin contributing. Start by contributing a little rate of your pay into a retirement account or an speculation finance. As your ventures develop, you’ll be able to spare cash for your future and increment your budgetary stability.Conclusion

Saving Money is an achievable objective, and with the right procedures in put, you can spare cash effectively. By making a budget, computerizing your reserve funds, cutting superfluous costs, and setting clear objectives, you can take control of your funds and construct riches over time. Whether you’re Saving Money for an crisis support, a major buy, or retirement, each little step you take can lead to enormous money related rewards. Begin nowadays, and observe your reserve funds develop!Read More latest Posts

- Who Is Alex Cosani? Biography And Rising Fame Explained Now

- Erin French Age, Biography, Career, and Net Worth Details

- Star Wars Puns That Are So Hilarious They’re Out of Galaxy

- Mayim Bialik Husband Identity And Relationship History Revealed Here

- TechVib’s Guide to the Best Amazon Echo Speakers in 2025